Contents

Ontvang de beste CloudBilling-content van de week

Effective invoice processing is a vital financial element for any MSP, and today, more than ever, it is essential to prioritise it. Many organisations still rely on old-fashioned manual invoicing methods, however, these have been proven to be less efficient compared to automated solutions.

Levvel research reports that manually processing one invoice can mean an average expense of up to $15 US. These costs can add up quickly, especially for companies dealing with a significant number of invoices.

Automating this process offers great potential for improving efficiency and financial success for Managed Service Providers (MSPs). With that in mind, our aim is to provide you with a comprehensive understanding of invoice processing.

In this article, we will start by defining invoice processing and then delve into the comparison between manual and automated invoice processing, by highlighting the advantages of automation. At the end of this blog, we'll provide you with an automated solution that can do wonders for you, as an MSP. So, without further ado, let's dive right in!

First things first, what is Invoice Processing?

Invoice processing is the procedure for checking and settling supplier invoices. It involves a series of actions that take place from the moment you receive the invoice from a supplier until it is officially paid and documented in your financial records.

No matter how you get the invoice - by post, email with a PDF, or electronically - you need to enter the information into your accounting system. Then the invoice goes through a specific process to be approved and paid. Keeping accurate financial records is essential for improving relationships with suppliers, avoiding penalties for late payments, and following financial regulations. To achieve this, companies need to set up a structured invoice processing system. Now, let’s look at traditional manual invoice processing!

Manual Invoice Processing

Manual invoice processing has many disadvantages. To help you understand them better, we present the main reasons behind these challenges:

Error-prone:

Even the most skilled employees on your team can make mistakes. Factors such as fatigue, stress, distraction, boredom and even just plain misreading can all contribute to errors in manual data entry. Errors tend to get bigger, especially when you are dealing with calculations or managing extensive data tables.

Time-consuming:

We have all experienced it at some point - spending endless hours working on a task, only to find out at the end that we have overlooked something, forcing us to start all over again. Manual invoicing is not only a time-consuming and inefficient process but also results in delays in approval and payment.

Lack of insights:

Processing invoices manually often does not provide real-time tracking of invoice status and responsible parties for approvals, especially for a large number of invoices. This lack of visibility can lead to delays, miscommunication, missed payments and strained relationships with suppliers. As the number of invoices increases, the problem gets worse, and it becomes more difficult to maintain clarity and accountability.

Limited scalability:

Manual invoice processing faces significant challenges when scaling operations for MSPs. It is not flexible enough to handle fluctuations in demand, such as during holidays or sudden spikes in orders. During a spike in demand, for instance, you have to hire and train additional staff, which, if not done efficiently, can lead to missed orders, customer dissatisfaction and damage to your reputation.

Moreover, as your business grows and the number of invoices increases, scaling traditional manual processes is labor-intensive and time-consuming, preventing adaptability to changing circumstances.

Processing invoices manually presents numerous challenges, and the list seems never-ending. The good news is that there is a solution that can take your invoice processing to a whole new level of efficiency - automation.

Automated invoice processing

Automated invoice processing involves extracting data effortlessly from incoming invoices and integrating it seamlessly into your ERP system, simplifying the payment process in just a few clicks. It almost sounds too good to be true, doesn't it?

By implementing automation, it means that the challenges typically associated with traditional invoice processing become a thing of the past. Let’s delve deeper into the reasons for automation in the next section.

Why you should automate invoice processing

As mentioned previously, manual invoice processing methods have historically been associated with inefficiency and frustrating delays.

Automated invoice processing represents a game-changing way MSPs handle their invoices, bringing several advantages, including time, cost savings, greater accuracy and valuable insights.

Here’s a list of the 5 key advantages when automating these tasks:

1. Reduced errors:

You will spend less time and effort on correcting invoice-related errors, and it can even reduce the need to reissue checks, ultimately saving your business time and money.

2. Time Savings:

Automation not only accelerates the pace of invoice processing but also significantly reduces the daily workload for your team. By utilising specialised invoice processing automation software, you can cut down the processing time dramatically, often achieving completion in just 3 or 4 days.

3. Cost Savings:

You can reduce time, resources, and expenses associated with manual invoicing and payment processing. This change allows your team to redirect their efforts towards activities that increase your revenue, such as increasing sales and expanding your business, while reducing the time spent creating invoices, filing, correcting, and processing payments.

4. Getting Better Insights:

These insights not only simplify your financial processes but also equip your commercial teams with the essential data to make more informed decisions. It allows them to effectively plan future expenditures, model potential revenue streams, and lay the foundations for stronger growth strategies.

5. Increased Efficiency:

The automated system ensures that you can effortlessly scale up to process an increasing number of invoices without compromising on accuracy. With just a few clicks, you can quickly analyse any facet of your accounts payable process. This improved accessibility and data-based decisions can significantly improve the efficiency of your company's operations.

Invoice Processing: Key Considerations

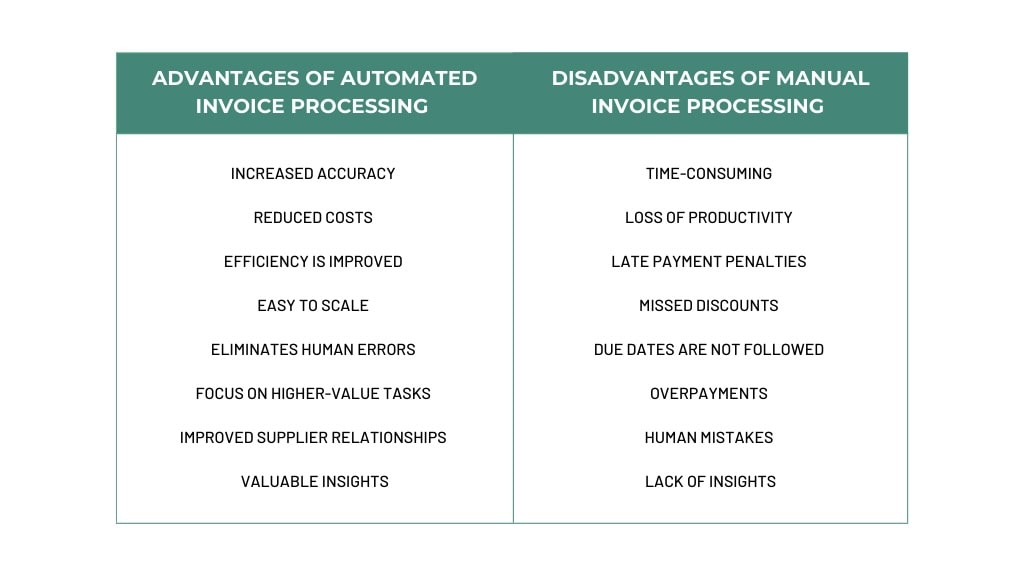

Evaluating the transition to an automated solution requires a thorough assessment of your company's needs and resources. You must weigh up the advantages and disadvantages, comparing them directly in order to make an informed choice.

By carrying out this thorough evaluation, you can make an informed decision that aligns with your company's goals and financial considerations.

Here’s an overview of the advantages of automated invoice processing and the disadvantages of manual processing:

If the idea of automating your invoice processing piques your interest, be sure to keep on reading as we will present the perfect software solution in the next section.

Automate your Invoice Processing with CloudBilling

CloudBilling makes all the advantages mentioned above achievable with a specific focus on delivering exceptional value to Managed Service Providers (MSPs). Simplify your invoicing process by sending multiple invoices in bulk, saving time and effort.

CloudBilling offers multi-cloud versatility, supporting various platforms such as Microsoft, AWS, Google Cloud, and VMware, enabling you to manage expenses across multiple cloud environments from a unified interface.

Customise your billing and cost management strategies to align with your business's unique needs. Contact us for a free demo and discover how CloudBilling can streamline your invoice processing and boost your business efficiency.